There’s a school of thought within financial circles that says that bull markets do not die of old age but rather due to extraneous factors such as overconfidence, overspending and over-leverage. Unfortunately, this raging bull market could be about to fall into the same trap.

That’s the opinion of one punter who fears investors are being a tad cavalier about the latest China coronavirus outbreak.

Kevin Muir, veteran trader and author of the popular Macro Tourist blog, is worried that US stock markets have largely brushed off the threat posed by the viral outbreak and could end up paying down the road.

The Dow Jones was down by just half a percentage point on Tuesday’s session while the S&P 500 fell 0.27% after the latest report from Beijing revealed that the pandemic has so far claimed nine lives and infected 400 people especially in the City of Wuhan with one case in the U.S. having been officially confirmed.

Millions of Chinese are expected to travel to various destinations as the two-week-long Lunar New Year holiday kicks off on 25th January, thus increasing chances of contamination.

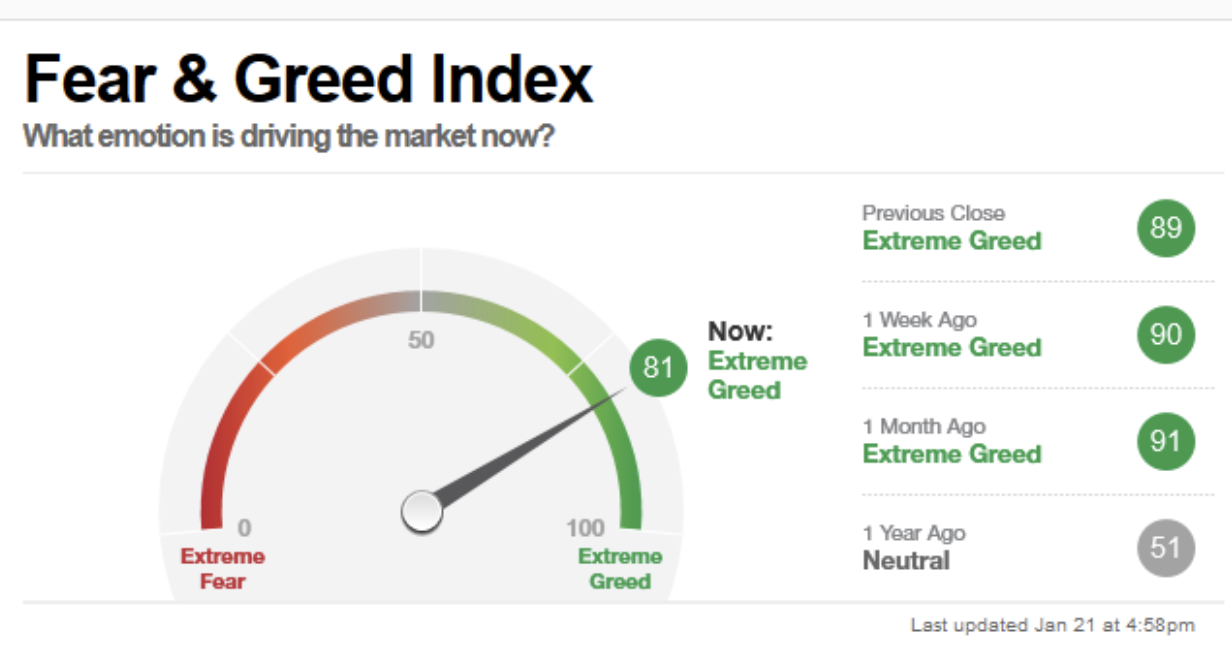

Meanwhile, CNN’s Fear & Greed Index shows the market remains in ‘Extreme Greed’ territory suggesting the markets don’t consider the outbreak a major threat to economic growth or future returns.

But as Muir has admonished, maybe investors need to be a little more concerned than they are right now.

(Click to enlarge)

Source: CNN Money

Black Swan Event

Muir sees the coronavirus outbreak as a black swan event with unpredictable yet potentially damaging consequences. He warns that the markets could be lulled into a false sense of security before something triggers panic selling and everything comes tumbling down:

‘‘I don’t like trafficking in end-of-the-world predictions,” Muir wrote in his latest blog post. “Yet there is sometimes a potentially worrisome situation that the market seems to ignore. Or at least ignores for a while. Then in a sickening whoosh, the worse case scenario gets discounted.’’

”The market is not ready for this new development,” he added. “Today was the first day the market showed even the slightest bit of concern. And my guess is that today will prove the start of a growing worry, not the other way round.”

Muir’s worries are not without merit. To be fair, stocks of companies with heavy exposure to China as well as online travel agencies and airlines sold off quite heavily on the latest updates. Still, the markets have not reacted anywhere near as adversely as they did during the BSE, aka mad cow disease, or SARS outbreaks 17 years ago which slammed meat packers, whole restaurant chains and the food sector in general quite badly.

Yet, the latest coronavirus might not be as innocuous as the common flu virus.

About 70 percent of newly discovered infectious diseases to have emerged over the past three decades have been zoonotic, meaning they can be readily transmitted from animals to humans. SARS is a well-known coronavirus that stems from a virus that occurs naturally in bats that spilled over into civet cats–wild animals that are considered a delicacy in China. The latest coronavirus has also been established to have spread through the sale of game meat, meaning the economic and social toll could eventually approach that by SARS and BSE.

One important distinction between the stock market then and now: the SARS and BSE outbreaks came at a time when the market had already hit rock-bottom after the devastating dotcom crash of 2000 whereas the latest outbreak comes at a time when the market is at all-time highs and feared to be on its last legs.

An overheated market increases the odds of a panic selloff.