Any safe haven asset worth its salt is supposed to rise and shine when all hell breaks loose in the financial markets, providing an escape hatch from market turmoil.

Going by that criterion alone, bitcoin and the crypto markets have failed investors miserably during the ongoing COVID-19 crisis.

Last month’s epic collapse by bitcoin and the rest of the crypto universe eclipsed the equity markets selloff and seriously undercut crypto’s safe haven credentials. Instead of buying more bitcoin as cities and entire countries went into total lockdown, the coronavirus outbreak just proved how much people value cash–and toilet paper.

Investors rushed to liquidate their financial assets–including cryptocurrencies– en masse and stockpiled on huge rolls, leading to bitcoin crashing 60% in a matter of weeks and #toiletpapergate and #toiletpapercrisis suddenly trending on social media.

Crypto analyst Scott Melker, aka ‘The Wolf of All Streets’, could not resist taking a jibe at crypto, though he maintains a soft spot for bitcoin:

“…crypto crash exposed the massive dysfunction in what has been proven to be a very immature space. The fallout has not even begun – exchanges and projects will likely start disappearing in the near future. Bitcoin will be fine. Crypto as an industry is somewhat screwed for the foreseeable future in my mind. I’m not talking about the price of coins. People will continue to pump and dump them. Trading is fine. The core premise of crypto is damaged.”

Bitcoin Price(USD)

Source:CoinDesk

Mass Panic

The huge positive correlation between bitcoin and stocks has come as a major disappointment for crypto buffs as the metric climbed to a multi-year high.

Bitcoin though is hardly alone; traditional safe haven assets have not exactly shot the lights out during the coronavirus crisis.

Gold prices dipped from the March peak of $1,678.55/oz recorded on March 9 to a low of $1,471.54 on March 19, representing a 12.4% drop in just 10 days. That marked the sharpest drop by the yellow metal over the past five year stretch, which says a lot for a commodity that’s supposed to be among the most stable.

To be fair, though, gold was sitting near multi-year highs before the selloff so the pullback might have been partly technical in nature. Also, gold has gained about 12% in the year-to-date in dollar terms, unlike other safe havens that are in the red.

Silver fared even worse, falling from 18.57/oz on February 24 to this year’s low of $11.99 on March 19, good for a 35.5% decline.

Meanwhile, the stock market’s popular benchmark, the S&P 500 Index, fell from 2,789.82 points on 20th February to 2,237.40 points on March 23–a 20% drop.

Gold Spot Price (USD)

Source: TradingView

Source: CNN Money

It’s quite clear that no single asset was safe during the latest bear market, which vindicates cryptocurrencies somewhat.

The global pandemic spooked investors everywhere pretty badly such that they rushed to sell even their supposed ‘safer assets’.

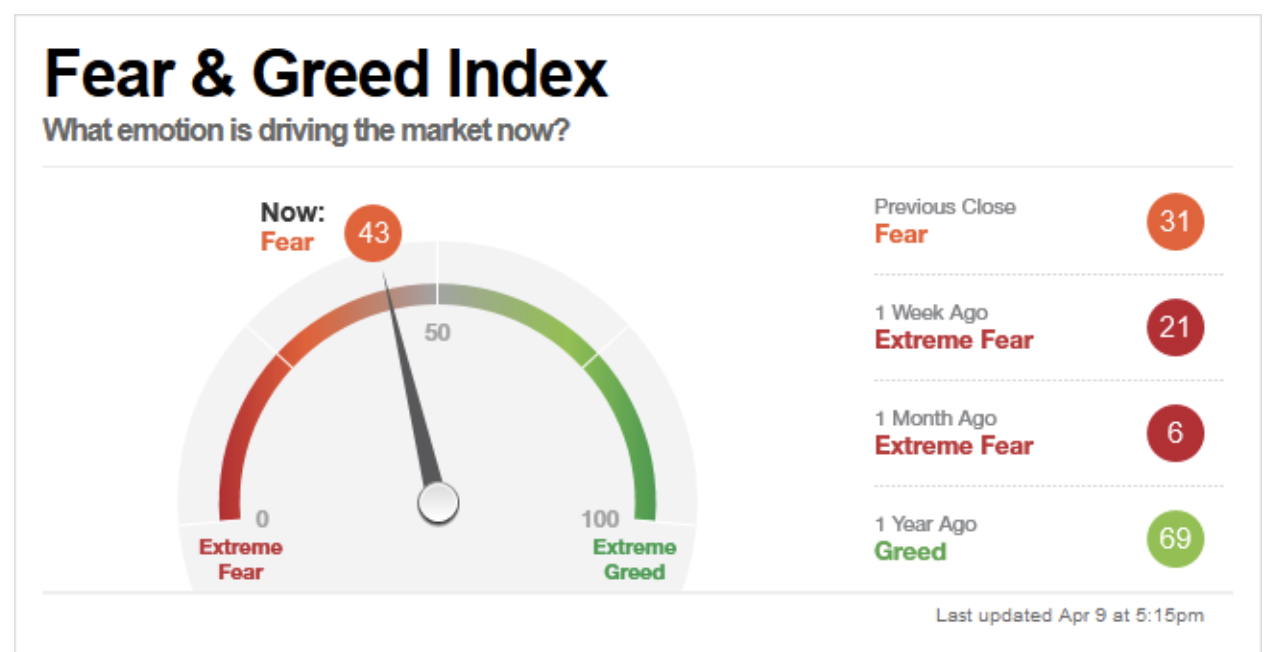

A month ago, fear in the markets reached historical lows as demonstrated by CNN’s Fear and Greed Index. As the saying goes, ‘Cash is King’—and that mantra is likely to continue ringing true unless interest rates tumble below zero in the coming months.

Source: CNN Money

In fact, we could argue that the fact that investors were able to sell so much of their crypto holdings so fast proves that the crypto market has matured enough and offers similar liquidity gateways to traditional assets such as gold and silver.

If you think that line of reasoning is a wee bit preposterous, consider that it has been advanced as a reason why gold’s safe haven status remains safe despite its recent underwhelming performance. Brien Lundin, editor of Gold Newsletter, recently told MarketWatch:

“If gold’s being sold to raise cash in an emergency, which is what appears to be happening now, then it is doing its job as a safe haven.”

But Lundin offers gold, and maybe bitcoin, bulls hope that a recovery might not be far off:

“Investors are selling anything with a bid and running for cover, and that includes typical hedges like gold. We saw similar behavior during the 2008 financial crisis, however, and once investors understood and appreciated the scope of central bank stimulus coming down the pike, they began buying gold. The price more than doubled from the lows thereafter.”

The Inflation Play?

True to word, gold, silver, bitcoin and the stock markets have staged an impressive recovery thanks to a raft of stimulus packages by governments across the globe.

In March, Congress approved a historic $2 trillion stimulus package to help the flagging economy weather the health crisis. More recently, the Fed revealed it will provide $2.3 trillion in loans to support the economy. Other nations are exploring similarly radical measures, case in point being the UK, which recently announced plans to pay 80% of the wages of workers on furlough.

While injections of huge amounts of cash into the global economy can potentially trigger inflation and encourage investors to park more of their money in safe assets like gold and bitcoin, recent historical evidence does not exactly support this line of thinking.

Investors widely expected hyperinflation in the wake of the 2008 financial crisis due to the huge asset-purchase programs and fiscal stimulus by governments. What actually followed was a decade of very low inflation, and the same situation could be about to play out again.

Indeed, Eric Stein, co-director of global income at asset manager Eaton Vance, has told the Financial Times that he expects inflation to return to just below the Fed’s target before the COVID-19 outbreak.

Long story short: don’t rush to buy bitcoin expecting a huge Fed-induced rally.

By Alex Kimani for Safehaven.com

More Top Reads From Safehaven.com: